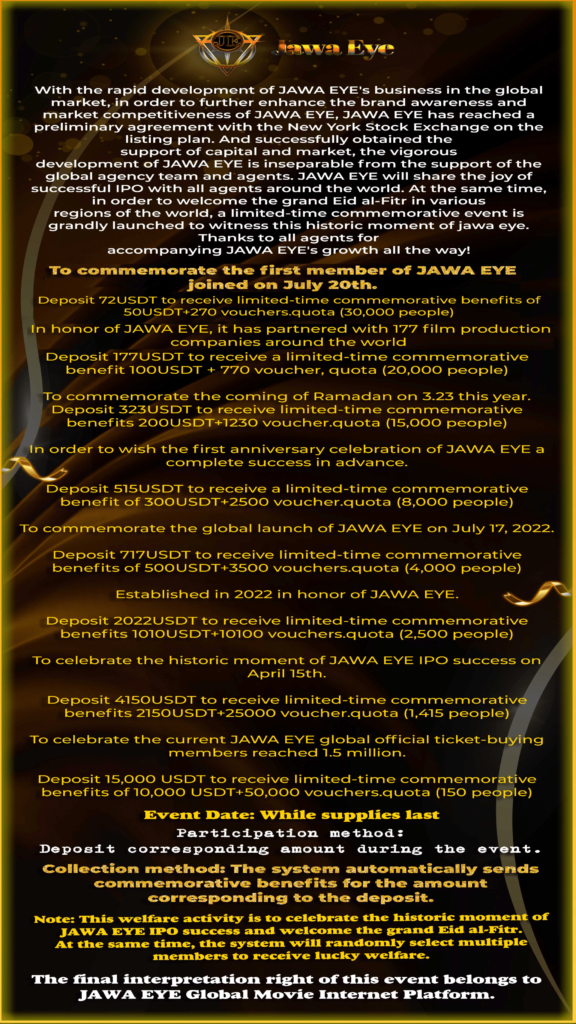

The theft of around Rs. 25 billion from thousands of Pakistani residents is allegedly the crime of the phoney smartphone app JawaEye. The phoney investment software gave the impression that it was based in Indonesia and ran like a Ponzi scam, offering investors substantial returns. Although the app was taken down from the Google Play store, its website kept luring users in with a sign-up fee that started at a minimum of Rs. 15,000. Additionally, the app’s Google Play page had a dubious description, and it was advertised in dozens of Facebook groups and hundreds of YouTube videos.

Users have to invest $50 in order to download the app and begin making money from it. Users had to wait months to break even because to the low earnings, but during that period they were given bigger profits to entice other people to sign up. Recent app evaluations revealed that customers had begun to realise they were being conned, but it was already too late.

Only apps that have been registered with the appropriate regulators, such as the State Bank of Pakistan (SBP) or Securities and Exchange Commission of Pakistan (SECP), should be available on the Play Store, according to the SECP. Even so, the app’s operation in Pakistan for months without any response raises severe concerns about the effectiveness of pertinent departments. The Federal Investigation Agency (FIA) has filed a FIR against certain people who are connected to this fraudulent enterprise in District Sahiwal. According to the FIR, criminal organisations are exploiting unlicensed local agents in several places to conduct illicit foreign exchange transactions in Sahiwal.

It is important to remember that unless it is registered with the appropriate departments, an unlicensed app cannot offer financial services. The most recent occurrence emphasises the need for tougher regulations against these fraudulent practises and for the general public to exercise caution when considering investment options that seem too good to be true.